🇸🇪 AFRY study shows how the EU CBAM could jeopardise North Sea offshore grid infrastructure

A report from AFRY Management Consulting has been released, which presents the results of its evaluation of how the EU Carbon Border Adjustment Mechanism (CBAM) will affect electricity imports from Great Britain.

AFRY Management Consulting has published a report summarising its assessment of the impact of the EU CBAM on electricity imports from Great Britain. The study was commissioned by a group of interconnector businesses and transmission companies to provide an independent assessment of the potential effects of the EU CBAM.

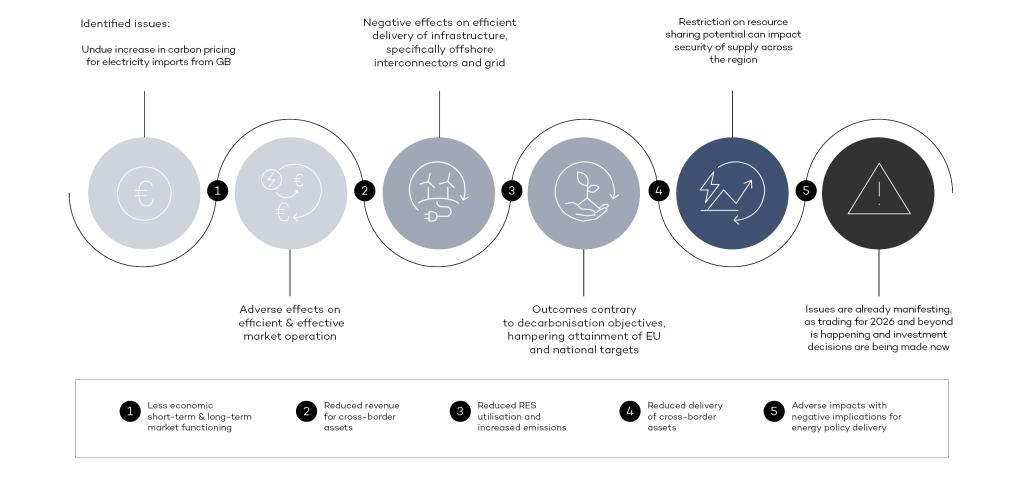

The study identifies two issues with the method of application of CBAM to electricity imports from GB:

- Risk of significant over-statement of emissions assumed for electricity imports from GB, as values based on carbon intensity of historic fossil fuel generation are likely to be applied.

- Excessive carbon price exposure for imports from GB, linked to practical obstacles to demonstration of a carbon price having been paid in GB by emitting generation and exposure of GB zero-carbon generation to carbon costs.

These issues unduly increase the cost of electricity imports into the EU from GB, presenting the following adverse outcomes:

• Putting at risk development of offshore grid/cross-border infrastructure needed for the energy transition;

• Harming delivery of decarbonisation policies by presenting barriers to low carbon projects; and

• Frustrating efficient market operation by unduly blocking flows that would otherwise be economic.

“Through the study, we show that EU electricity imports from GB could decrease significantly, with export of green electricity from GB amongst the blocked flows. The scale of potential flow reductions could have a big impact on investment decisions for new cross-border projects and on financial results for existing assets,” said Asimina Karakyriakou, Principal at AFRY Management Consulting.

“CBAM enters into full force in 2026, but trading for this time period and beyond is already happening and investment decisions for the future are being taken, so impacts are already being felt. Action is needed now to address the issues identified,” said Simon Bradbury, Senior Principal at AFRY Management Consulting.

“EU CBAM in its current form could create a very significant trade barrier for electricity imports into the EU even if the carbon prices in the third country are identical. This would negatively impact all dimensions of the energy trilemma. Political will is urgently called upon to get the identified issues addressed and an EU CBAM exemption for the UK e.g. via relinking the ETS schemes should be examined,” said Bart Goethals, Chief Commercial Officer, Nemo Link Ltd.

Originally published on 7 March by AFRY.

Announcements are published as a service to readers. The sender is responsible for all content.

Announcements for publication can be submitted to pr***********@ar**************.com.</small