Alaska oil lease sales draw more than $5 million in bids for North Slope and Beaufort Sea

Per-acre bids were among the highest in the program's history, but overall revenue was far lower.

Businesses spent more than $5 million for leases giving them the right to explore for oil on state-owned territory in the Arctic, the Alaska Department of Natural Resources announced last week.

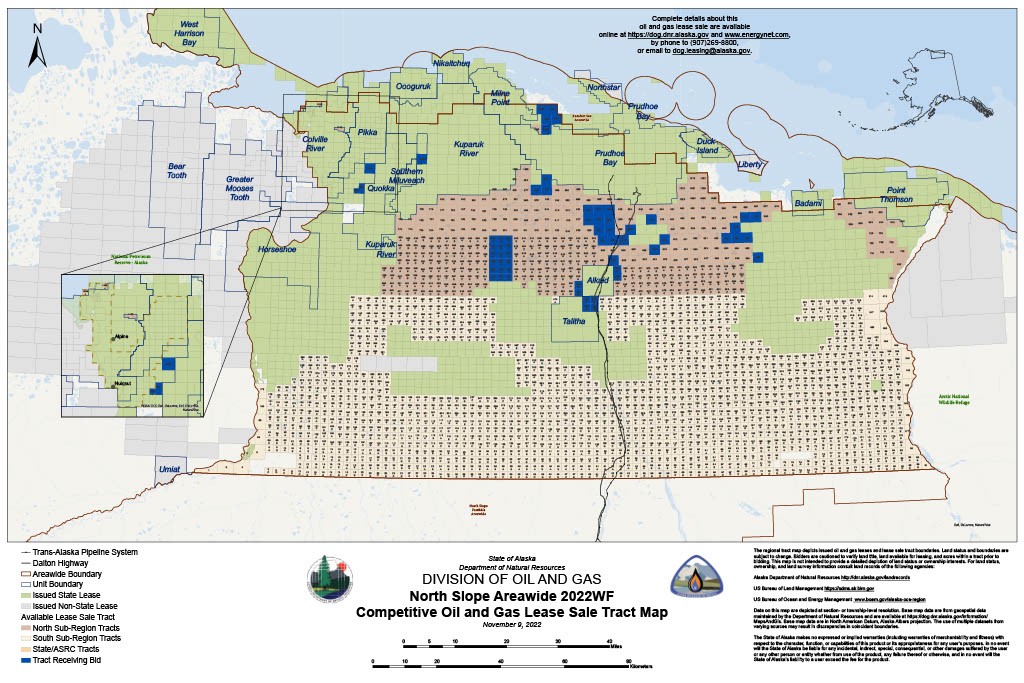

The 2022 areawide North Slope lease sale held once a year by the Division of Oil and Gas was the main attraction, with 63 bids received for 61 tracts and over $4.5 million offered in high bids for 121,412 acres, the department said. A simultaneous state Beaufort Sea sale drew $575,146 in bids for 17,212 offshore acres, the department said.

In a statement, the department touted the preliminary results as good for the state economy and the Alaska Permanent Fund, the state-owned oil wealth account.

“Alaskans will be pleased to see the oil resource that seeds critical investments like our permanent fund is continuing to enjoy international interest and support,” Acting Natural Resources Commissioner Akis Gialopsos said in the statement.

The average bids per acre — $37.28 for the North Slope and $35.41 for the Beaufort Sea – were among the highest per-acre amounts in the history of the state’s areawide leasing program, the statement said. The Beaufort Sea is the portion of the Arctic Ocean north and east of Utqiagvik and west of the Canadian islands.

Measured by total dollars offered in high bids, however, it was one of the least lucrative state North Slope lease sales held since the first areawide lease was held in 1999. Only six areawide North Slope sales yielded lower total high bids. Some totals were substantially lower, such as the sale held a year ago, which drew only six bids totaling $467,472 in total high bids.

Among the active bidders were Oil Search (Alaska) LLC, which picked up tracts near its newly formed Quokka Unit on the western North Slope, and Great Bear Petroleum Ventures, which picked up tracts near its Alkaid and Talitha prospects south of Prudhoe Bay.

The Quokka Unit, approved in June, lies south of the Pikka Unit, a site that Oil Search and its corporate parent, Australia-based Santos Ltd., call “one of the largest conventional oil discoveries made in the United States in the last 30 years.”

Santos in August announced a plan to start Pikka oil production in 2026; the field is expected to produce 80,000 barrels a day, the company said. That compares to total North Slope oil production that has veered between about 450,000 and 500,000 barrels per day over the past year, according to state Department of Revenue figures.

Other active bidders in the lease sale included Hilcorp, the Texas-based independent that in 2020 acquired BP Exploration (Alaska) Inc.’s North Slope assets and took over from BP as the operator of the Prudhoe Bay oil field.

The Beaufort Sea lease sale results, with 11 bids for nine tracts, were similar to results of recent years’ state sales for that offshore area.

No bids were received in the Division of Oil and Gas’ areawide lease sale for territory in the Brooks Range Foothills. There have been no bids submitted in the annual foothills lease sales since 2014, and the two bids submitted that year never resulted in any leases being transferred. The foothills area lies well south of Prudhoe Bay.

More oil and gas lease sale results are expected by the end of the year. Under a provision of the Inflation Reduction Act, a federal Cook Inlet lease sale that was canceled earlier this year for lack of industry interest was resurrected. That sale must be held by year’s end, according to the law, even though recent history shows very little industry interest in offshore oil and gas exploration in Cook Inlet.

This story was first published by Alaska Beacon and is republished here under a Creative Commons license. You can read the original here.

This article has been fact-checked by Arctic Today and Polar Research and Policy Initiative, with the support of the EMIF managed by the Calouste Gulbenkian Foundation.

Disclaimer: The sole responsibility for any content supported by the European Media and Information Fund lies with the author(s) and it may not necessarily reflect the positions of the EMIF and the Fund Partners, the Calouste Gulbenkian Foundation and the European University Institute.