🇺🇸 Arctic drilling likely a money-loser for Alaska in early years

By Yereth Rosen, Alaska Beacon

ANCHORAGE — A GIANT oil-development project just approved by the Biden administration and celebrated by Alaska state leaders is expected to cost the state treasury more than it would raise in the early years.

The Willow project, estimated to hold 600 million barrels of recoverable oil, would spur a cumulative loss of more than $1 billion (€940 million) in oil-production tax revenue over about 10 years, according to a state Department of Revenue analysis. That is because the billions of dollars that ConocoPhillips is expected to spend building Willow will be used to offset the tax bills elsewhere from production elsewhere on the North Slope, according to the analysis, issued on 28 February.

Willow would become cash-positive to the state in the 2035 fiscal year and, through the 2050s, generate $5.4 billion in state revenues over its lifetime, according to the analysis.

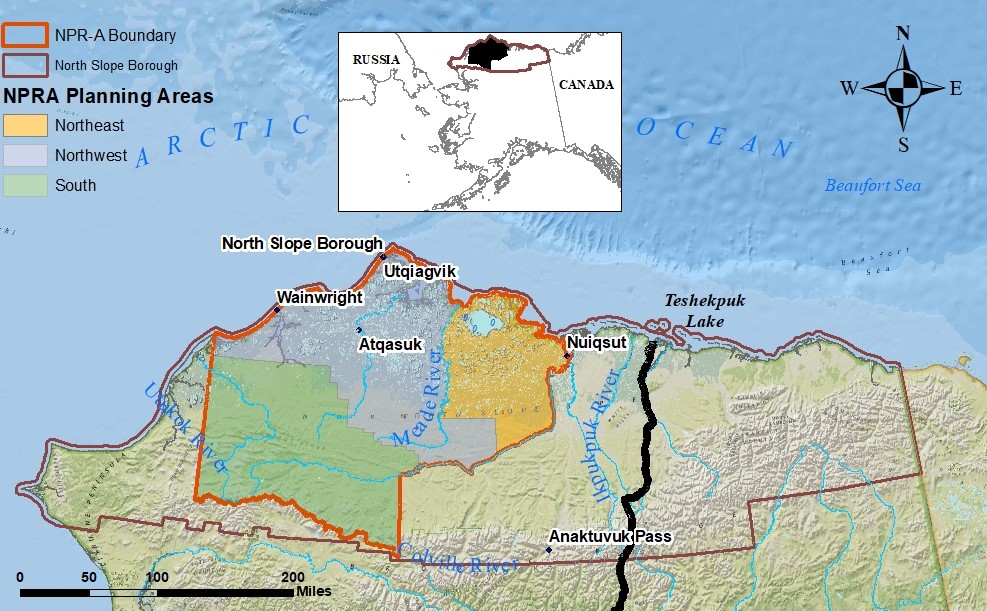

Willow would be the western-most producing North Slope oil field if developed and is located on federal territory, the National Petroleum Reserve in Alaska. That has profound implications for expected state revenues. While oil production on state land generates royalty revenues that go into the state’s general fund, royalties from oil production within NPR-A are effectively split between the federal government and the local communities on the North Slope. The royalty revenues intended for communities are placed into the state-administered National Petroleum Reserve-Alaska Impact Mitigation Grant Program, then distributed for specific projects.

Through that program and through other avenues, communities on the North Slope are poised to reap financial benefits from Willow, money that is vitally important, said Nagruk Harcharek, president of the Voice of the Arctic Inupiat, an organisation generally supportive of oil development.

In a statement released after the Biden administration announced its approval, Mr Harcharek called Willow “a new opportunity to ensure a viable future for our communities, creating generational economic stability for our people and advancing our self-determination”.

Willow is expected to produce more than $1 billion in property-tax revenues to the North Slope Borough and add $2.5 billion to the NPR-A Impact Mitigation Grant Program, “supporting social services, youth programs, civic facilities and more throughout our communities”, Mr Harcharek said.

The expected state revenue loss in the first years of Willow’s life was no secret to lawmakers. In November of 2018, the administration of former governor Bill Walker released an analysis to legislators that calculated that, over 10 years, the state would lose over $1.64 billion through development of Willow and other projects in the National Petroleum Reserve in Alaska.

The 2018 report used some different parameters and assumptions. In addition to anticipated effects on state revenue of Willow development, it factored in the effects of two smaller oil projects: Greater Mooses Tooth 1, which started production that year; and Greater Mooses Tooth 2, which started production in late 2021. It assumed an oil price of $75 a barrel, though it considered some other prices. And it assumed that Willow production would start in 2024, much earlier than is now expected.

Alaska leaders in recent days have acknowledged Willow’s initial negative fiscal impacts to the state but said other positive economic impacts will flow from the project.

“You know, this is on federal land, so you’re not going to see the revenue potential that you would see on state land,” Mike Dunleavy, Alaska’s Republican governor, said in a news conference on Monday.

Still, there will be jobs for the workers building and operating Willow, he said. And more oil into the Trans Alaska Pipeline System means that the 1,300km system’s life “will be extended for a certain period of time”, he said. That could make other oil development more likely, arresting or even reversing the North Slope’s long-term production decline, he said. “The hope is that we continue to find plays, we continue to develop those plays. And we continue to, at the very least maintain, if not increase,” he said.

In a news conference on Tuesday, Cathy Giessel, who leads the majority Republicans in the state senate, said the tax structure that is poised to produce several years of losses to the state is fair to industry.

“You take the risk of investing in this hugely expensive process of drilling wells, you need to be able to recover your costs before we start taxing you,” she said. It’s also fair for the state to have its revenues deferred, she reckoned.

“That’s part of the cost of doing business, in my perspective,” she said.

And the money going to North Slope communities is an important positive benefit for the state, she said.

However, to Bill Wielechowski, a Democratic senator, the negative cash flow shows a flaw in the state’s tax system.

“We’re basically picking up a huge chunk of the cost and others will be getting the benefits when this is all said and done,” he said in an interview. “The state will be subsidising a huge part of this project.”

That situation would have been remedied if voters in 2020 had passed an initiative changing the state’s oil production tax structure, according to Mr Wielechowski. Under provisions of the initiative, he said, “you could just ring-fence it,” meaning that Willow costs could not be used to offset taxes on oil production elsewhere. “It’s an easy fix, actually,” he said.

Alaska voters rejected the initiative, with about 58% voting against it.

Mr Wielechowski, who along with Ms Giessel is a member of the bipartisan Senate majority, said he is happy that the Biden administration approved Willow. But he said the current situation might spur another look at oil-production tax changes.

FURTHER READING

• Green groups sue Biden administration over Willow oil project

• Analysis: Legal challenges could delay Alaska’s Willow oil project

• Biden administration approves massive Willow oil project in Alaska

• Biden issues limits on oil drilling in Alaska, Arctic Ocean

• Voice the Arctic Iñupiat on latest Willow Project reports

• A willow the greens can do without

• Alaska’s DC reps lobby Biden to approve Willow oil and gas project

• As a new review gets underway, the future of a huge Arctic Alaska oil project is uncertain

• Biden administration backs smaller version of ConocoPhillips project

• A US federal judge throws out the approval of a major new oil project in Alaska’s Arctic

• Appeals court halts construction at ConocoPhillips’ Willow project in Alaska’s Arctic

Alaska Beacon is part of States Newsroom, a network of news bureaus supported by grants and a coalition of donors as a 501c(3) public charity. Alaska Beacon maintains editorial independence. Contact Editor Andrew Kitchenman for questions: in**@al**********.com. Follow Alaska Beacon on Facebook and Twitter.

This article has been fact-checked by Arctic Business Journal and Polar Research and Policy Initiative, with the support of the EMIF managed by the Calouste Gulbenkian Foundation.

Disclaimer: The sole responsibility for any content supported by the European Media and Information Fund lies with the author(s) and it may not necessarily reflect the positions of the EMIF and the Fund Partners, the Calouste Gulbenkian Foundation and the European University Institute.