Energy Transition: New Energies Means New Opportunities for Alaska

Alaska has a strong legacy in the oil and gas industry. Oil’s accessibility, versatility, ease of transport, and relatively low cost fueled our modern society and enabled Alaska to grow and mature in ways impossible without it. It provides us with energy and heat, is a key ingredient to many of the products we depend on daily, and fuels the transportation industry critical to Alaska. While fossil fuels currently power most of the global economy, oil is not our future. In order for Alaska to flourish and thrive in the 21st century, we can’t afford to gamble on an industry on the decline. Driven by economics, technological progress, and overwhelming public pressure, the world is moving away from oil.

As a state, we are at a crossroads. The global energy transition has the potential to upend Alaska’s economy by decimating the price and demand for our oil exports. Alternatively, this same energy transition can be the greatest wealth creation opportunity of our lifetimes. That’s because Alaska’s unique geography, history, natural resources and our decades of experience as an energy state positions us well to be a leader, not a victim, of the inevitable energy transition.

Alaska is no stranger to the economic benefits of fossil fuels

Fossil fuels supply nearly 80% of all global human energy needs. For Alaska it is the engine of nearly our entire economy. According to a recent study by the McDowell Group, 24% of all wage and salary jobs in Alaska are directly related to oil and gas. Beyond that, with each direct O&G job, there are eight more jobs supported by oil and gas activity and seven more supported by oil-related taxes and royalties. Alaska is the only state to have neither a state sales tax or a personal income tax, because our state government has largely been funded by the oil and gas industry. Every year we individually receive a Permanent Fund Dividend (PFD) funded almost entirely from oil and gas royalties and settlements. No other sector comes close to generating more economic impact in Alaska than the oil and gas industry.

But the oil legacy of Alaska almost didn’t happen. In 1964 when Governor Egan selected Prudhoe Bay for development, many called it Marshall’s Folly after the petroleum geologist tasked with picking the 100 million acres that would be granted by the federal government for state use. For a typical oil-field at the time, a prospect needed to be more than 100 million barrels to make business sense. For Alaska’s remote and rugged North Slope, it would need to be more than 1 billion. For a young state that didn’t have much to lose, it was still a big gamble.

By 1967 and dry well after dry well, most oil companies had given up. ARCO and Humble Oil moved the only remaining oil rig on the North Slope to Prudhoe Bay to drill the very last test well and for weeks the drilling was like watching the grass grow. Then one day the crew opened a valve to test the well pressure and it sounded like a jet plane overhead. They ignited the gas gushing out and it sparked a 50-foot flare that burned over eight hours. A second well confirmed the massive discovery – the biggest in North America – of 9.6 billion barrels of oil that forever changed the fate of the State of Alaska.

For more than three decades, however, the overarching story for the North Slope has been one of decline. After hitting a peak of more than two million barrels per day, oil production in Alaska has declined more than 75 percent since 1988. In the past few years, production has actually increased as Hilcorp has acquired BP’s North Slope assets. The state is looking to Hilcorp and independents like them for a turnaround that would extend the North Slope’s life and create hundreds of jobs while investing millions of dollars in some of the basin’s oldest sites. With Hilcorp’s strong track record of increasing production in older fields, Alaska is once again betting big on oil to revive our flailing economy.

Oil and gas majors signal fossil fuel decline and transition to renewables

Alaska’s wager on oil is in stark contrast to the broader trend of oil majors fleeing fossil fuels. In response to the exponential growth of the renewable energy sector, the decline of hydrocarbon markets and from pressure of shareholders and climate activists to reduce carbon emissions, oil majors are identifying new strategies to profit from the energy transition. BP has divested itself of its Alaska assets and exited the state. Its 2020 annual Energy Outlook revealed projections that global oil demand peaked in 2019 and will decline even more rapidly in the face of stronger climate action. This further cuts the prospects for fossil fuels and raises the expectation for renewables. BP took one step further and developed plans to reach net-zero emissions by 2050 as an ‘integrated energy company’ ready to move ‘beyond petroleum’, rather than an oil major.

““[This is] the biggest transition our modern-day energy systems have ever seen.”

BP isn’t the only oil major making such sweeping changes to their business model. Oil majors around the world are identifying new strategies for capturing their share of the market resulting from the energy transition. The CEO for Royal Dutch Shell told investors it was no longer just an oil and gas company, but an ‘energy transition company’ as a part of its diversification strategy. Seeking to diversify revenues away from volatile oil prices, the French oil major Total is strategically investing in future energy growth markets and recently announced it was leaving the American Petroleum Institute because of differences over climate policy. Italian multinational oil and gas company Eni is investing in renewable energy in order to ensure the company’s ability to adapt to a low carbon future. And Norwegian oil major, Statoil, changed its name to Equinor to reflect a shift in strategy from an oil-focused company to a ‘broad energy company’ in the future, aiming to be at the forefront of “the biggest transition our modern-day energy systems have ever seen”.

The future of energy is electric

This powerful and even long-term trend is from a world of diverse energy sources to one predominantly electric. Driven by electricity’s transportability and steadily decreasing costs, the future of infrastructure is electric. The state-of-the-art long haul transport for electricity, high-voltage DC (HVDC) transmission, has comparable carrying capacity and orders of magnitude as oil and natural gas pipelines. While the price of natural gas, gasoline, and heating oil have generally been constant or trending upward in the long term, the price of electricity has decreased over the last 50 years. Combined with its last-mile transport costs far less than even natural gas or coal, electricity stands out as the easiest, most flexible, and cheapest way to deliver energy to its point-of-use.

Starting when Edison achieved his vision of a full-scale power system with the Pearl Street Station in Manhattan in 1882, end-use energy consumption has steadily increased over the last 140 years and with it our quality of life. Ensuring the abundance of affordable energy is perhaps the single highest priority for the health and well-being of our communities. In this way, the global trend toward clean energy is a story of optimism because decarbonization is good for us – economically, environmentally and socially. Even considering the supply chains for wind and solar energy versus the extraction of fossil fuels, the dramatic reduction in air pollution from combusting fuels – up to 80% – means human health is the big winner in a decarbonized world.

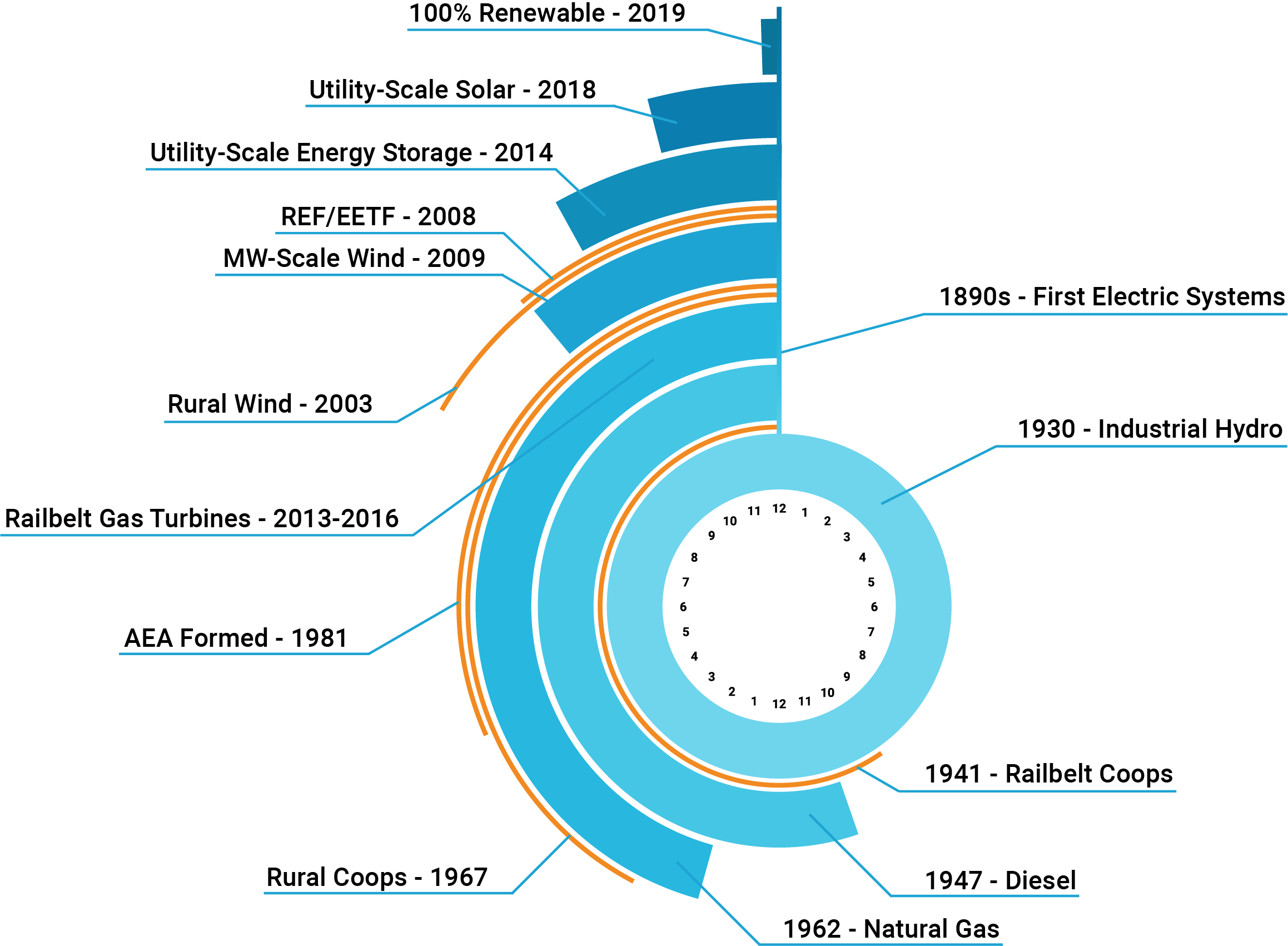

The trends of electrification and decarbonization have been evident for decades now in Alaska’s power systems. If you map our energy transition to a 24-hour clock, our rapid evolution is illustrated clearly: our first utility scale wind project comes online around dinner and in just the last 15 minutes of the day rural utilities are operating with up to 100% renewables.

Alaska’s future will be powered by clean energy, and it’s already started

Our state’s power systems continue to evolve at an escalating pace. For one, with the exception of the natural gas power plants built by the Railbelt utilities between 2013 and 2016, new generation projects have been increasingly focused on renewables. Wind generation has been integrated into rural power plants starting in 1997 and urban utilities followed suit around 2012.

Somewhat surprisingly, utility-scale solar has also grown in the last two years. Though Alaska’s solar resource is largely mis-matched with its winter peak demands, the relative affordability, simple maintenance, and complimentary summer production profile has been embraced with new solar project records set and broken multiple times since 2018.

An early adoption of energy storage across the state preceded the more recent solar ‘boom.’ The growing trend of hybrid energy projects combining storage with wind and solar is enabling renewables to reach higher clean energy penetration in both urban and rural areas of Alaska and storage systems are becoming larger and more common. There are currently over a dozen utility-scale energy storage systems operating throughout Alaska.

Remote communities are deploying increasingly complex systems that include diesel and multiple forms of renewables such as hydro, wind and solar combined with energy storage. Many of these systems incorporate dispatchable loads making them some of the most sophisticated power systems in the world in one of the most extreme environments. These systems require very complex and automated controls that balance the dynamics of renewable generation and dispatchable loads with the most efficient and cost-effective dispatch strategy. Embedded in these systems are advanced algorithms that are refined through the institutional knowledge of our power plant operators and exported around the globe.

One example of these incredible systems can be found on Kodiak Island. There, they have combined 31MW of hydro with 9MW of wind generation, 3MW of battery energy storage, and 2MW flywheel energy storage to operate annually with over 99% renewable energy. Typically the only reason Kodiak Electric Association (KEA) does not operate at 100% renewable energy annually is because they still need to exercise their diesels for the very rare instance they are required to provide backup power. Beyond the obvious complexity of managing a small independent power system with so many generation assets, the City of Kodiak also operates a very large crane – so large that it introduces considerable instability into the power grid – enough to take the system down on its own. KEA’s use of flywheel energy storage to completely mitigate the impact of the crane to the local grid garnered global attention and has become an industry standard for managing dynamic port power systems. In fact, nearly mirror copies of KEA’s storage system can be found in major cities like Los Angeles today.

Investing in Alaska’s energy future

Alaska has already directly invested over $250 million in advanced remote power systems, or microgrids, through the Renewable Energy Fund (REF), established in 2008, and the Emerging Energy Technology Fund (EETF), established in 2010. With over 200 microgrids operating for the last 50 years across the state and a total installed capacity exceeding 800MW, Alaska has the largest install base of microgrids in the world. Meanwhile, the global microgrid market is estimated to be over $2.4 billion today and forecasted to reach over $5.8 billion by 2023. Alaska’s early work in microgrids and renewable integration makes the state a global leader in the energy transition.

As Alaska’s first accelerator, this makes the team at Launch Alaska very excited for the tremendous opportunity it represents for us as a state. Our mission is to accelerate the resource revolution and to find cost effective and reliable solutions for decarbonizing and electrifying our critical systems. Forever grateful for the prosperity and legacy provided by our oil and gas partners, we can join them in shaping the economy of Alaska’s future and realizing the massive wealth creation opportunity that presents itself in the energy transition.

With 40,000 Alaskans on unemployment and 90,000 having received assistance this year, the coronavirus pandemic hits a workforce already suffering from stagnant oil prices and a constricted state economy. The transition to clean energy provides us with a unique opportunity to rebuild the Alaska economy using the skilled workforce of pipefitters and welders, electricians and plumbers, and programmers and technicians trained on the North Slope. At the same time we’re developing our local workforces to install and maintain the new clean energy infrastructure, we’ll be giving our community economies a boost by investing locally the dollars formerly exported on fuel.

In doing so, the energy transition becomes an economic multiplier for Alaska. With the foundation of the oil industry’s legacy, the first mover advantage in high-penetration renewables and microgrids, and our experience in mega-projects, Alaska stands poised to be a global leader in the energy transition. As Alaskan’s we’ve never been scared of getting our hands dirty and working hard to build big, visionary things. Let’s leverage our legendary spirit once again as energy pioneers in the Last Frontier to rebuild our economy for future generations of Alaskans. And, yes, let’s even partner again with our oil and gas colleagues who are themselves investing in the energy transition, if they’re so inclined. After all, we owe it to them for helping us get to where we are today.

But this time, let’s bet on ourselves.

Disclaimer: The opinions expressed here do not necessarily reflect those of ArcticToday’s staff or owners. This piece was originally posted on the website of Launch Alaska on 31 March, 2021.