Liberty, an ambitious offshore oil project that once sparked excitement, is now in limbo

Though they were both seen at different times as groundbreaking Arctic Alaska developments, there are some important differences between Willow and Liberty.

Before the ConocoPhillips’ massive Willow project emerged as a subject of excitement and controversy, a different North Slope oil project promised to open a new Arctic oil frontier.

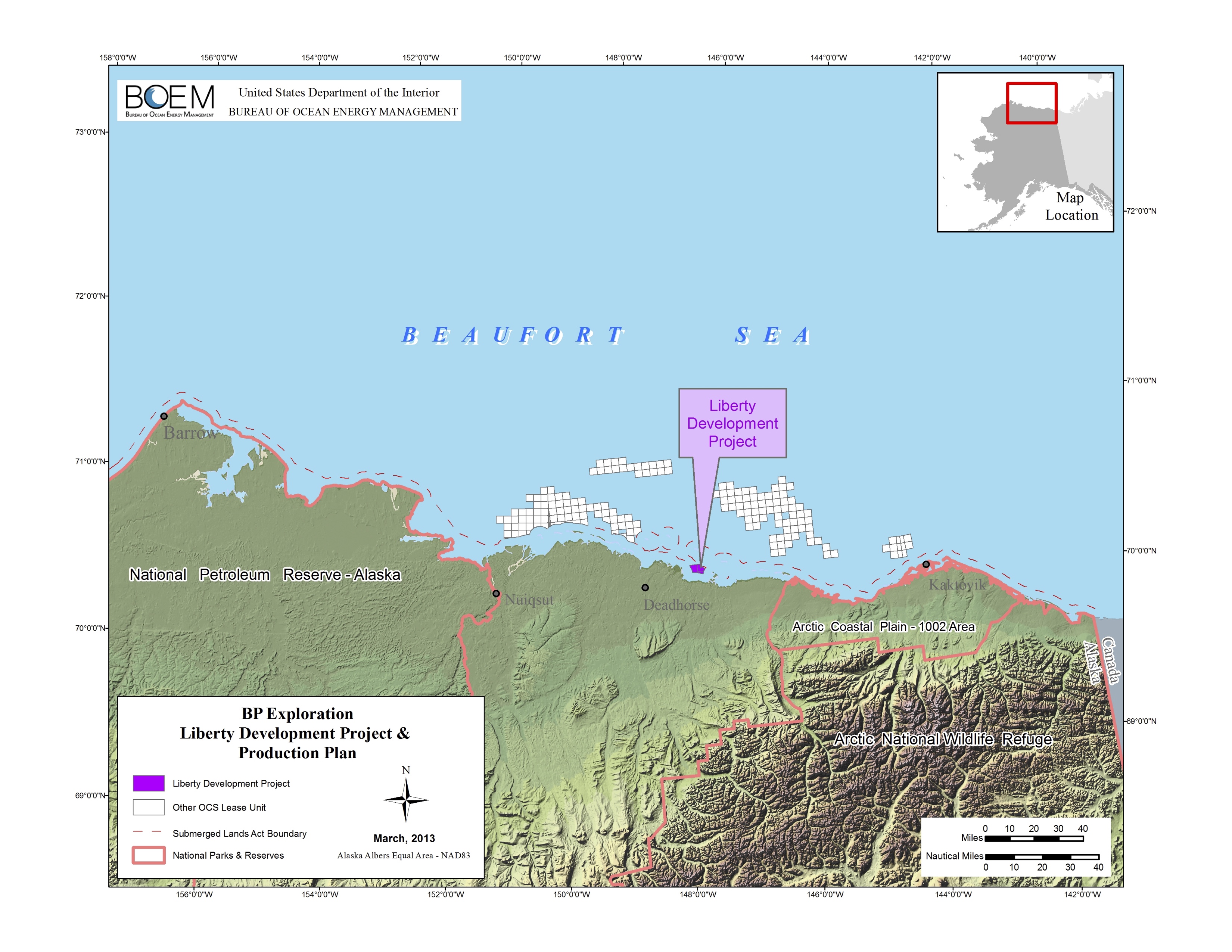

The Liberty field, with an estimated 150 million barrels of recoverable oil, was to have been the first producing oil field located entirely in the federally controlled Outer Continental Shelf, in the icy Beaufort Sea.

It has a long history, dating back to Royal Dutch Shell exploration drilling in the 1980s. It was pursued by BP Exploration (Alaska) Inc. for two decades. It is now part of Hilcorp’s Alaska portfolio after BP sold off its Alaska assets and, ultimately, departed the state.

And it is currently in limbo.

As state officials pin high hopes on Willow and the revenues and jobs it will generate, the history at Liberty provides a cautionary tale about the uncertainties of oil development projects.

Just a few years ago, Liberty’s current owner was projecting confidence in the project. A Hilcorp development and production plan – the third drawn up over Liberty’s lifetime — was approved in late 2018 by the Bureau of Ocean Energy Management. But that approval was overturned by the federal 9th Circuit Court of Appeals on Dec. 7, 2020.

At Hilcorp’s request, BOEM’s sister agency, the Bureau of Safety and Environmental Enforcement, in December of 2019 put the three leases that comprise the Liberty prospect into suspension, a status that was renewed in 2021, according to BOEM. The suspension is in effect for three years and stops the clock from ticking toward lease expiration, according to BOEM.

The agency in 2021 asked Hilcorp if it still planned to pursue the project; Hilcorp responded in 2022 with a letter saying it is updating its Liberty oil-spill response plan.

BOEM said in a statement that as of March, it had not received an updated plan.

That history has left Liberty on the sidelines amid the discussion and controversy about the ConocoPhillips’ much-bigger Willow project.

“Liberty seems like an age ago,” said Erik Grafe, a staff attorney for Earthjustice, an environmental law nonprofit. Grafe managed litigation against federal approval of the project.

Fifteen years ago, however, there was much excitement in Alaska about Liberty.

BP had an ambitious plan to develop the project by producing oil from the shore using ultra-extended-reach drilling. Liberty would have the longest wells in the world, potentially reaching up to 40,000 feet in length, to be drilled by the world’s largest land-based drill rig, commissioned by BP and built by Parker Drilling specifically for the project.

The $1.5 billion project received the go-ahead from BP’s corporate headquarters in 2008, and the company’s Alaska leaders hailed that news with an announcement to reporters.

“This is about as sexy as it gets,” BP Alaska Exploration Inc. President Doug Suttles told reporters at the time. “This is an example of what I’ve referred to as exploration through technology.”

Two years later, Suttles was BP’s chief operations officer and was embroiled in the response to the Deepwater Horizon disaster in the Gulf of Mexico. Four years after BP sanctioned Liberty, it officially withdrew the development plan, even though construction at the site had already started. In 2018, dismantling work began on the giant rig BP had built for Liberty; the rig wound up never drilling a single well. In 2019, BP announced it was leaving Alaska and selling off its remaining assets – including Liberty – to Hilcorp. That sale was made final in 2020.

BP’s ultra-extended-reach drilling project was never a good idea, said Mark Myers, a former Alaska Department of Natural Resources commissioner who served previously as director of the U.S. Geological Survey and director of the Alaska Division of Oil and Gas.

“It was just, technologically, a bridge too far,” said Myers, a geologist who serves on the U.S. Arctic Research Commission and previously also served as a chancellor for research at the University of Alaska Fairbanks.

The problem with such long-distance directional drilling is that it would have required too much drilling through a difficult shale layer, called Kingak, that is known for swelling and slumping, Myers said. Typically, operators on the North Slope try to limit their penetration of the Kingak layer, he said.

The plan for ultra-extended-reach drilling was replaced by a more traditional Alaska development and production plan featuring an artificial island similar to four others that are in use elsewhere on the North Slope. That island plan was the one overturned by the 9th Circuit Court of Appeals in 2020. No updated plan has yet been submitted to federal regulators.

Despite the stall, there are still factors weighing in favor of Hilcorp eventually developing the Liberty project, Myers said.

“The oil’s there. It’s not very far from infrastructure,” he said. “They’re definitely motivated to do it.”

The nearby infrastructure, importantly, is now owned and controlled by Hilcorp, eliminating the need for what might be a difficult negotiation with other parties for access, he said.

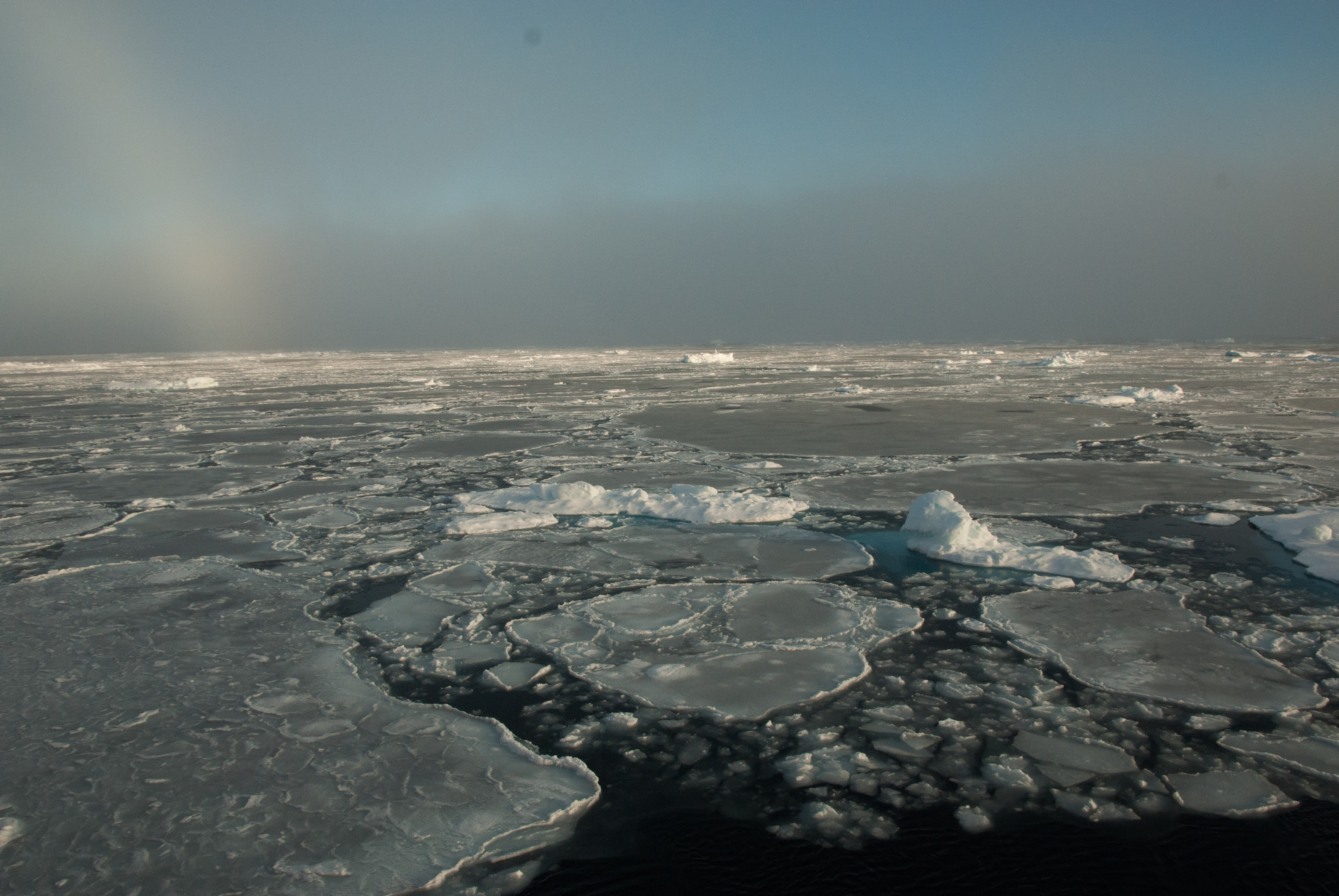

On the negative side is Liberty’s location, Myers said. “Offshore is always more tricky than onshore,” he said. Arctic ice – which can gouge underwater oil structures – is one of the major complications, he said.

Another point weighing against Liberty’s development, Myers said, is President Biden’s withdrawal of remaining Beaufort Sea territory from future oil and gas leasing schedules. The action putting the unleased portions of the Beaufort off-limits to future development came at about the same time the administration approved the Willow project.

The withdrawal does not affect the existing leases in federal waters of the Beaufort – the three currently suspended Liberty leases and the three leases that are part of the Hilcorp-operated Northstar unit, which is mostly on state territory. But it diminishes investment prospects on those existing leases, Myers said. “It is easier to get investment if you have an active leasing program,” he said. If there is no leasing program, “it’s giving the message that it’s a difficult place to work.”

Hilcorp, which now operates the giant Prudhoe Bay field and other fields acquired from BP, may be busy with work other than Liberty, Myers said. “It’s got its hands full, likely, with its existing infrastructure,” he said.

And the risk of litigation continues, he said.

Hilcorp declined to respond to numerous requests for comments on its plans for Liberty.

Though they were both seen at different times as groundbreaking Arctic Alaska developments, there are some important differences between Willow and Liberty.

An obvious difference is location; Willow is onshore, where development is easier, while liberty is offshore. They differ in size; Willow is about four times as big in reserves, with about 600 million recoverable barrels estimated, and ConocoPhillips plans to spend several billion dollars on Willow, much more than the $1.5 billion planned by BP.

But there are links and parallels.

The legal issues that tripped up the federal government’s 2018 approval of Liberty’s most recent development plan also applied to litigation over the Trump administration’s initial approval of Willow in 2020. In both cases, courts overturned approvals based on what were considered flaws and omissions in the analysis of greenhouse gas emissions, Earthjustice’s Grafe said, though there were other issues in each case. While the Liberty case went all the way to the 9th Circuit Court of Appeals, the 2021 federal court ruling overturning Willow approval was not appealed. In Willow’s case, the BLM drew up a supplemental environmental impact statement that resulted in the Biden administration’s approval of a pared-back development plan.

Both Liberty and Willow are in federal territory, meaning that development would produce less revenue to the state than would be the case for oil fields on state land or in state waters.

In the case of Liberty, there was potential for the state to reap up to 27% of the royalties because of a federal law that allows for royalty sharing for oil produced between 3 and 6 miles offshore, under a provision of the Outer Continental Shelf Lands Act. The environmental impact statement released by BOEM in 2018 estimated such revenues would total $1.4 million a year. The state would not be entitled to taxes on oil produced at Liberty because that is federal territory, but it would have the ability to impose property taxes on any pipeline or other associated facilities that extend to state land.

In Willow’s case, what would be the state’s share of the royalties from produced oil is allocated by federal law to North Slope communities. Without royalty contributions to the general fund and with various tax credits that would reduce overall production tax revenues, Willow would lose the state money in its early years, with totals ranging from under $400 million to over $1 billion, depending on the estimate.

The Alaska Department of Natural Resources still includes Liberty in its list of projects that could produce oil in the future – albeit, not among the top five key projects like Willow that are considered most likely and most important.

Some legislators have expressed skepticism about Liberty’s inclusion in the list of pending oil projects.

Sen. Jesse Kiehl, D-Juneau, is among them. At a Jan. 18 hearing where DNR officials gave the production forecast – and made a passing mention of Liberty — he raised a question about the project, noting that he remembered hearing about its impending development many years ago when he was a legislative aide sitting in the same Senate Finance Committee room.

“I got the whole saltshaker out, not just the grain,” Kiehl said later about his remark.

This story was first published by Alaska Beacon and is republished here under a Creative Commons license. You can read the original here.