Moscow outlines a €210 billion incentive plan for Arctic oil

The new tax breaks are aimed at sparking more Arctic oil investment — and thereby growing traffic on the Northern Sea Route.

A new tax regime for the Russian Arctic aims to provide for an unprecedented wave of investment in oil and gas drilling in the region.

The new legislation, pushed through on January 30, will give national oil companies incentives for major investments in Arctic oil, the country’s new Prime Minister Mikhail Mishustin says.

“These laws will create favorable conditions for Arctic investments, the development of unique fields and consequently the accelerated development of the Northern Sea Route,” the premier said as his cabinet approved the legislation.

Northern Sea Route

The Arctic is high on the Russian political agenda and government officials are grappling with the task how to reach 80 million tons of shipments on the Northern Sea Route by year 2024. The shipping route is among the priorities in President Vladimir Putin’s so-called May Decrees from 2018 and the Ministry of the Far East and Arctic has prepared the new laws to reach those goal.

According to the ministry, the major tax releases that are included in the new legislation will pave the way for a series of new big oil and gas projects in the region. The projects will ultimately provide for a spike in shipments on the Northern Sea Route, the ministry argues.

Offshore drilling

Minister of the Far East and Arctic Aleksandr Kozlov says new projects now are likely to be developed both offshore and on land and that total investments could reach 14.7 trillion rubles (€210 billion).

That includes three new offshore projects with a price tag of 1.77 trillion rubles (€25 billion), his ministry informs.

The offshore projects will be provided with a 5 percentage production tax for the first 15 years.

Petrochemistry

Petrochemical projects in the region will also be given big incentives. According to Kozlov, a new zero percentage mineral extraction tax will ultimately result in the development of three petrochemical projects in the region with investments totaling 2.9 trillion rubles (€41.6 billion).

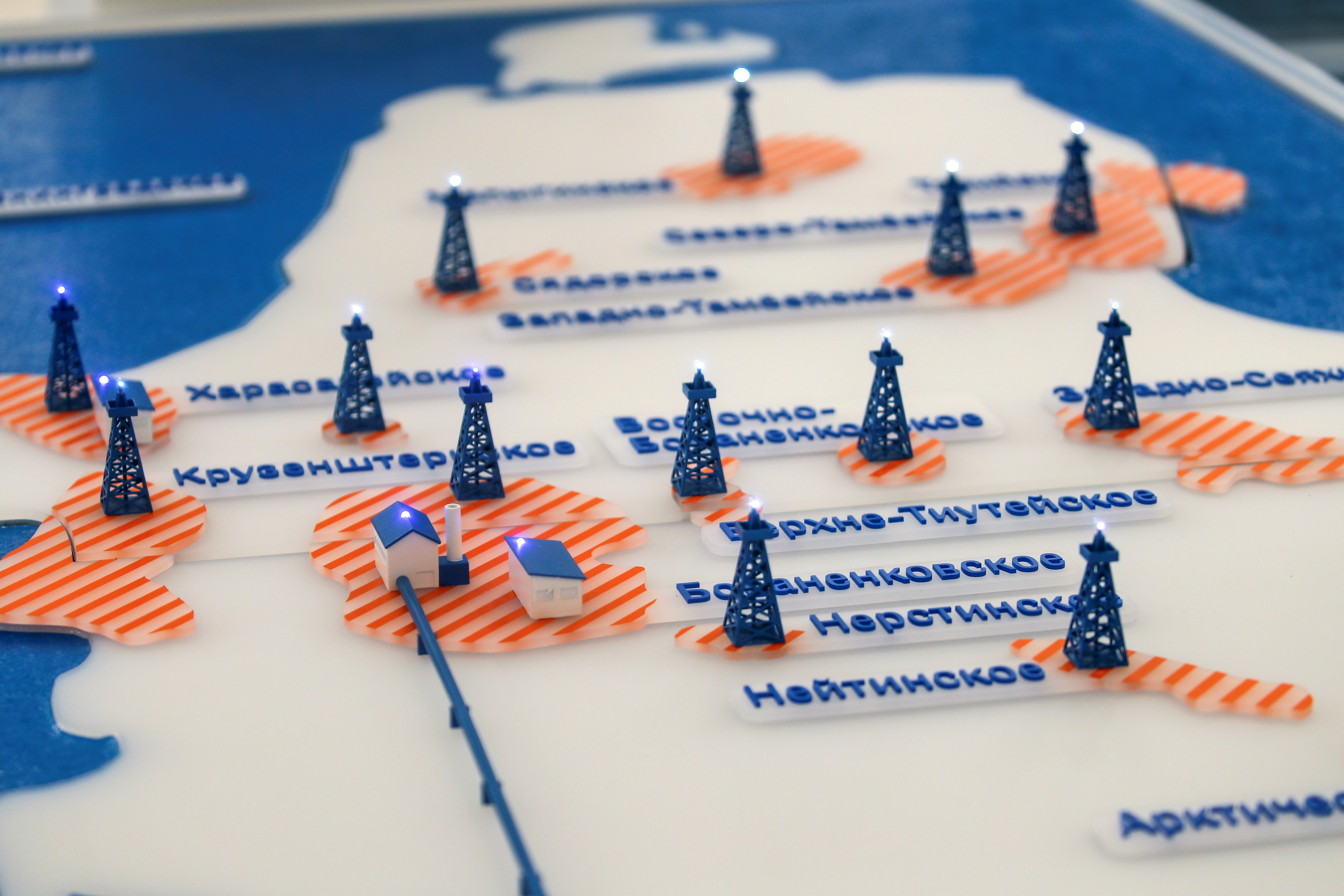

Natural gas company Gazprom is likely to be a driving force in the petrochemical projects. The state company is already planning the construction of a gigantic petrochemical plant in Bovenenkovo, the company hub in the Yamal Peninsula. It is to be able to produce about 3 million tons of plastics products polyethylene and polypropylene per year, company sources say.

Arctic Siberia

The Russian government also wants to intensify oil exploration in the country’s east Arctic where it will introduce a zero-level extraction tax for the 12 first year of new projects.

“As a result we are getting three new huge oil fields with about 10 trillion rubles (€143 billion) of investments,” Kozlov says.

Among the east Arctic project is likely to be Rosneft’s plans for its Vostok Oil, the fields in the Vankor region and export of oil through a new pipeline to the Taymyr Peninsula.

Also transport and infrastructure development is included in the new legislation. The companies that build new seaports in the region will benefit from zero percentage income tax for ten years. And shipping companies operating in the region will have no value added tax on shipments of export goods and icebreaker services.