American LNG developers see possible opening from US-China trade truce

A 90-day freeze on new tariffs has LNG projects — including one proposed for Alaska's Arctic — hopeful that China will commit to long-term gas export contracts.

NEW YORK — Companies proposing new U.S. liquefied natural gas export projects, including one in Alaska’s Arctic, expressed optimism on Monday the agreement between the United States and China temporarily halting the imposition of higher tariffs could help advance their projects.

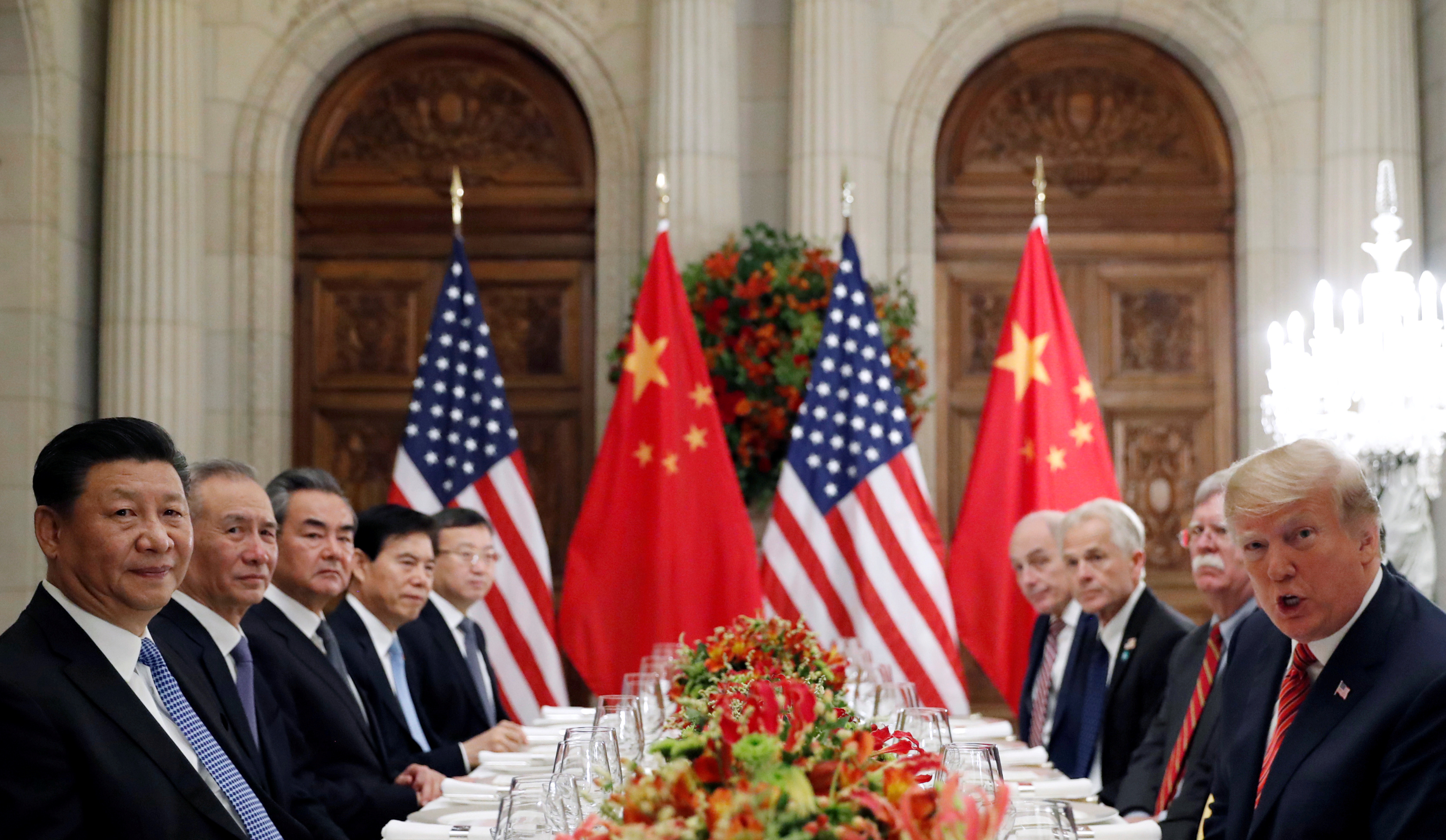

U.S. President Donald Trump and Chinese President Xi Jinping agreed on Saturday to a 90-day freeze on new tariffs to advance trade talks, declaring a truce following months of escalating tensions.

The decision “is a positive sign that the development of U.S. LNG projects will not be detoured in the immediate term by any further trade conflicts,” said Micah Hirschfield, spokesman for Liquefied Natural Gas Ltd, one of more than a dozen companies proposing new U.S.-based LNG export terminals.

The United States is the world’s fastest-growing exporter of LNG and China is the fastest-growing importer of the fuel. China bought about 15 percent of U.S. LNG exports in 2017, worth about $447 million. So far in 2018, China was on track to buy just 10 percent of U.S. LNG shipments.

Any cooling off of the trade war would help projects like LNG Ltd’s Magnolia project move to “execute long-term LNG export contracts with offtakers from China without punitive external factors,” Hirschfield said.

Alaska Gasline Development Corp, which expects in 2020 to make a final investment decision to build its $43 billion Alaska LNG project to pipe gas from the Arctic to a liquefaction and shipping facility further south, was “gratified that trade talks appear to be progressing,” said spokesman Jesse Carlstrom.

The company has continued negotiations with customers in China and elsewhere in Asia despite trade frictions, he said.

Some LNG executives and analysts said, however, that advancing more LNG terminal proposals to construction would require a more formal agreement conducive to signing long-term sales contracts.

“The market needs something more concrete than a 90-day reprieve of hostilities to confidently commit time and capital for projects that take several years to bring online,” said Matt Hong, director of research, power and gas at Morningstar Inc.

While a pledge by China to increase purchases of U.S. energy products may lead to a short-term sales boost, the need for long-term purchase commitments has not gone away.

“The reality of the situation is that not much has changed as far as the LNG sector is concerned,” said Abhishek Kumar, a senior energy analyst at Interfax Energy’s Global Gas Analytics.

“Investors are now looking for a tangible progress in trade talks and not just political gestures,” Kumar said.