While ANWR fight grabs headlines, a different part of Alaska’s Arctic is seeing a burst in oil exploration

While debate is focused on a controversial budget measure to allow oil drilling in the Arctic National Wildlife Refuge, a more accessible oil and gas frontier in Arctic Alaska is producing industry excitement and drawing significant investment.

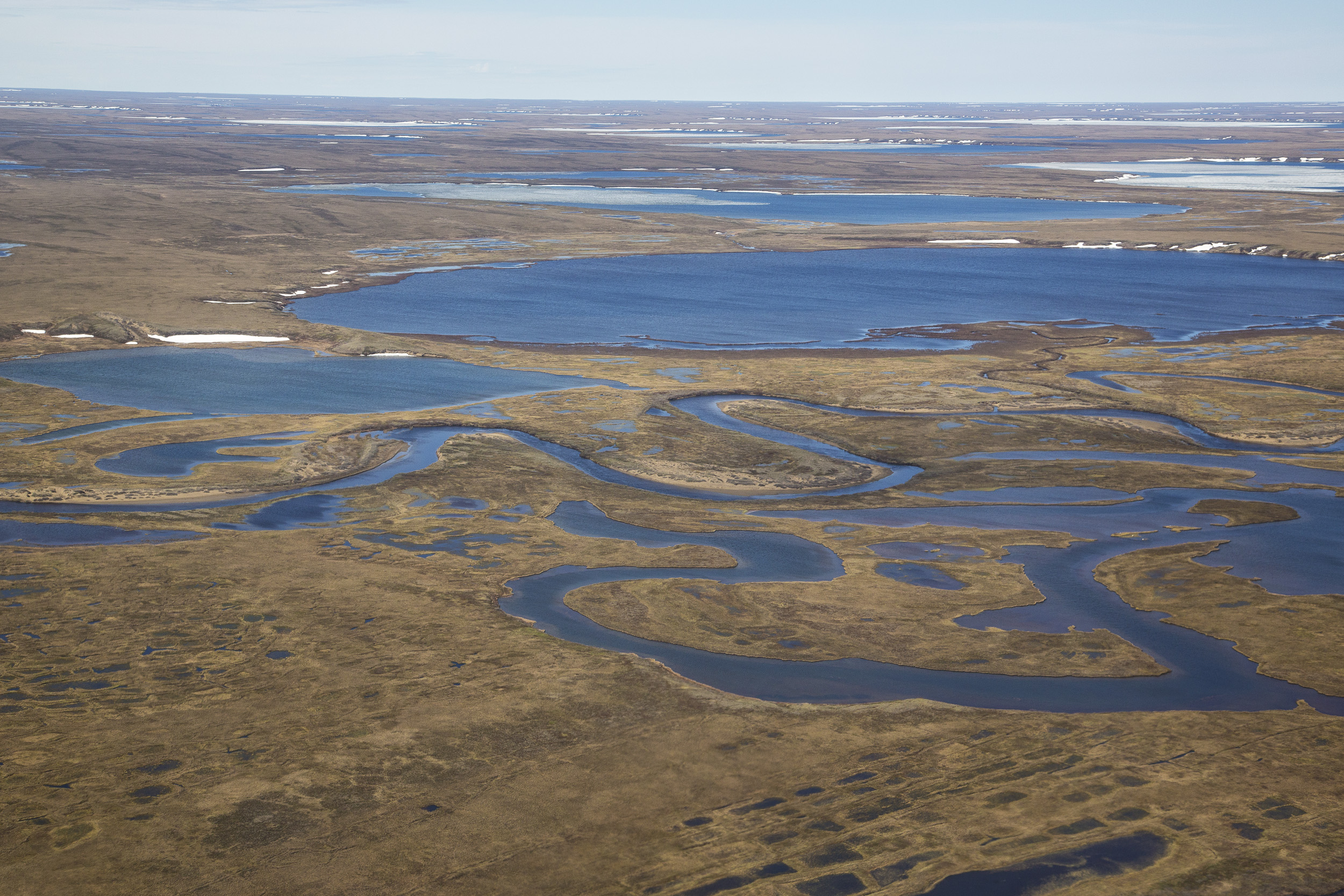

The National Petroleum Reserve in Alaska, or NPR-A, and adjoining state lands around the Colville River Delta on the western side of the North Slope have proved to be an attractive place for new oil development, thanks to recent and rich discoveries, accessibility of infrastructure and a series of projects in development that are poised to start producing in the next few years.

Recent discoveries in the area, on both state and federal land, are fueling predictions of new fields that will produce 30,000 to 100,000 barrels a day.

Oil companies have been very successful on the western side of the North Slope, a contrast to the east side where ANWR is located, said Andy Mack, commissioner of the Alaska Department of Natural Resources.

“The west side is starting to look very good,” Mack said. “Lately on the west side, there’s been these really prolific finds. Frankly, on the east side, we haven’t seen that level of action.”

In lease sales held Wednesday, oil companies picked up tracts adjoining current fields and prospects, poising themselves for potential expansion.

In the annual NPR-A lease sale held by the Bureau of Land Management, only seven tracts—out of 900 offered, covering more than 10 million acres— received bids. All were from ConocoPhillips, the company most active in NPR-A.

But in state land nearby, there was brisk bidding in a separate lease sale held concurrently by the Alaska Division of Oil and Gas. The state’s onshore North Slope lease ale drew $19.9 million, and bidding was concentrated in the western area near the NPR-A border. Another lease sale held Wednesday, for state territory in the Beaufort Sea, drew $1.25 million in bids.

The onshore North Slope lease sale total was the third-highest total for such state lease sales in two decades, state officials said. “To have the third-highest this year is extremely exciting for us,” Chantal Walsh, director of the Alaska Division of Oil and Gas, told reporters after the sale. Companies do not particularly care whether tracts are on the state side or the federal side of the NPR-A border, she said. “They just want to go out and have prospective exploration areas,” she said.

Compared to ANWR on the eastern side of the North Slope, NPR-A and state lands nearby have several advantages for industry.

The region is not a wildlife refuge, and the question of whether oil development will take place has long been settled. What is yet to be determined is how much oil development there will be and precisely where and how that development will occur.

The reserve, the largest federal land unit in the United States, was established in 1923 by President Warren Harding as the source of energy for the U.S. Navy, which was switching from coal to oil to fuel its ships. Then, it was one of four “naval petroleum reserves” in the nation. In 1976, management transferred to the BLM. While industry focused on Prudhoe Bay and the central North Slope, NPR-A was overlooked. Modern interest in NPR-A was ignited in the 1990s, when Arco Alaska – ConocoPhillips’ predecessor – discovered the huge Alpine field on state land just bordering the federal unit. Alpine is now an anchor field for other projects in the area.

Now the region is the site of recent discoveries, most of them linked to geological trend called Nanushuk that is believed to hold more than 1 billion barrels of recoverable oil.

This winter’s exploration and development season in the area will be busy.

ConocoPhillips’ exploration program is the most aggressive in several years, with four wells planned for leases within NPR-A and one well planned for state land nearby. The company is also working to develop its third operating field within the reserve’s borders. One, CD5, came on line in 2015 and is producing 28,000 barrels a day, far more than the 16,000 initially expected, Lisa Bruner, a ConocoPhillips Alaska vice president, said at the Resource Development Council for Alaska’s annual conference in November. The company is expanding CD-5 and doubling the number of producing wells there, she said.

A second field, called Greater Mooses Tooth-1, or GMT-1, is expected to start production in late 2018, sending 25,000 to 30,000 barrels per day into the pipeline. A third, GMT-2, is in regulatory review and is expected to start producing in 2021 at rates similar to GMT-1. ConocoPhillips last year announced a separate discovery, Willow, within the NPR-A, that it believes could be online in 2023 and produce 100,000 barrels a day.

Other companies active in the area as well. Armstrong Energy, one of the discoverers of the Pikka field on state territory just east of the NPR-A border, plans more exploration drilling this winter.

Tracts acquired in Wednesday’s lease sales fill in territory around existing projects on the western part of the North Slope. In a state lease sale, Repsol and Armstrong picked up acreage near Pikka, while ConocoPhillips picked up territory in NPR-A that borders its Greater Mooses Tooth unit.

To environmentalists, the sparse bidding in the NPR-A lease sale Wednesday suggests that companies — which already held more than 1.3 million acres of leased tracts in the reserve prior to the sale — do not need any more Arctic territory, contrary to positions taken by the Trump Interior Department.

“This lease sale is a black stain on the administration’s ‘lease everywhere’ approach, and a clear indication that there is simply no market for oil leasing in the Arctic,” Greg Zimmerman, deputy director of the Denver-based Center for Western Priorities, said in a statement. “Secretary (Ryan) Zinke and his lieutenants could use an Economics 101 refresher. You cannot force drilling where no demand exists—even when the government is practically giving leases away. And, equally importantly, some places are just too special to drill.”

The Trump administration argues that the most prospective NPR-A acreage is currently off-limits to development — a situation administration officials plan to change.

In an order issued May that targeted environmental restrictions throughout Arctic Alaska, Zinke mandated a review and possible revocation of the 2013 management plan that established five special protected areas in the reserve while leaving slightly over half available for oil leasing.

“The National Petroleum Reserve serves a critical role in both our energy and national security,” Zinke said in a statement released when he issued that order. “This is land that was set up with the sole intention of oil and gas production, however years of politics over policy put roughly half of the NPR-A off-limits.”